The Single Strategy To Use For Estate Planning Attorney

The Single Strategy To Use For Estate Planning Attorney

Blog Article

Things about Estate Planning Attorney

Table of ContentsThe Estate Planning Attorney DiariesEverything about Estate Planning AttorneyHow Estate Planning Attorney can Save You Time, Stress, and Money.The Facts About Estate Planning Attorney Revealed

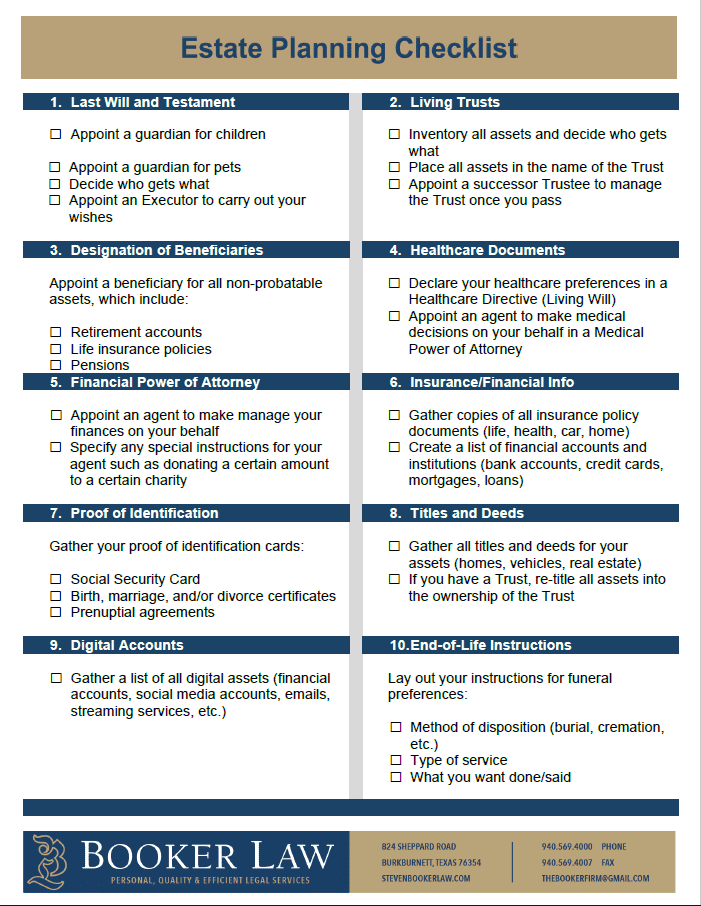

Estate planning is an activity strategy you can make use of to determine what occurs to your properties and commitments while you live and after you die. A will, on the other hand, is a legal document that lays out how possessions are distributed, that cares for youngsters and pets, and any various other wishes after you pass away.

The administrator also has to repay any type of taxes and financial obligation owed by the deceased from the estate. Financial institutions usually have a minimal amount of time from the date they were informed of the testator's fatality to make cases against the estate for money owed to them. Insurance claims that are rejected by the administrator can be taken to court where a probate court will have the last word regarding whether the claim is valid.

The Estate Planning Attorney Diaries

After the supply of the estate has been taken, the worth of properties calculated, and taxes and financial debt paid off, the administrator will then look for consent from the court to distribute whatever is left of the estate to the beneficiaries. Any type of inheritance tax that are pending will certainly come due within nine months of the day of fatality.

Each individual locations their possessions in the trust and names a person other than their spouse as the recipient., to support grandchildrens' education.

The Best Guide To Estate Planning Attorney

Estate coordinators can collaborate with the contributor in order to reduce gross income as a result of those contributions or formulate strategies that make the most of the effect of those donations. This is an additional approach that can be made use of to restrict fatality tax obligations. It involves a specific securing the present worth, and thus have a peek at these guys tax obligation, of their property, while connecting the worth of future development of that funding to an additional person. This technique entails cold the value of a property at its worth on the day of transfer. As necessary, the quantity of possible capital gain at death is additionally iced up, permitting the estate organizer to approximate their prospective tax obligation responsibility upon fatality and far better strategy for the settlement of income taxes.

If sufficient insurance policy profits are available and the plans are appropriately structured, any type of revenue tax on the pop over to these guys regarded personalities of assets adhering to the death of a person can be paid without resorting to the sale of properties. Proceeds from life insurance that are gotten by the beneficiaries upon the fatality of the guaranteed are usually earnings tax-free.

There are specific papers you'll require as part of the estate preparation procedure. Some of the most common ones include wills, powers of attorney (POAs), guardianship classifications, and living wills.

There is a myth that estate preparation is just for high-net-worth people. Estate intending makes it simpler for people to identify their dreams prior to and after they die.

Estate Planning Attorney - The Facts

You must start planning for your estate as quickly as you have any type of measurable property base. It's an ongoing process: as life advances, your estate strategy must change to match your conditions, according to your brand-new reference goals. And maintain at it. Refraining your estate preparation can cause excessive financial worries to liked ones.

Estate planning is usually considered a device for the rich. That isn't the instance. It can be a beneficial method for you to handle your assets and responsibilities prior to and after you pass away. Estate preparation is also a fantastic way for you to lay out prepare for the care of your minor kids and animals and to describe your wishes for your funeral and favorite charities.

Qualified candidates who pass the exam will be officially licensed in August. If you're eligible to rest for the test from a previous application, you might file the short application.

Report this page